Curated by Emily Andrew and Lewis Dalton Gilbert

Private View: Tuesday 30 January, 6 – 8pm

Exhibition: Monday 29 January – Friday 9 February 2024 (Monday to Friday 10.00 – 17.30)

Featuring: David Abbott, Frea Buckler, Tom Chamberlain, Neill Fuller, Adam Hedley, Angela Lizon, Myrna Myrna Quiñonez and Joe Warrior Walker.

From the Bloomsbury Group, St. Ives School and the YBA’s, the British art world has often been grouped together by location. Leaning on this tradition, this exhibition brings together sets of artists who work closely to one another to showcase the different styles, techniques and trends emerging outside the capital city. Our first focus is on Bristol and the South West.

Gurr Johns is an international independent art advisory firm giving leading professional insight into the art market to trusted consultants, private individuals, experienced collectors, family offices, lawyers, and art institutions. As an extension of Gurr Johns’ offerings, we hold exhibitions in our gallery space providing the next generation with a platform to show their works in central London.

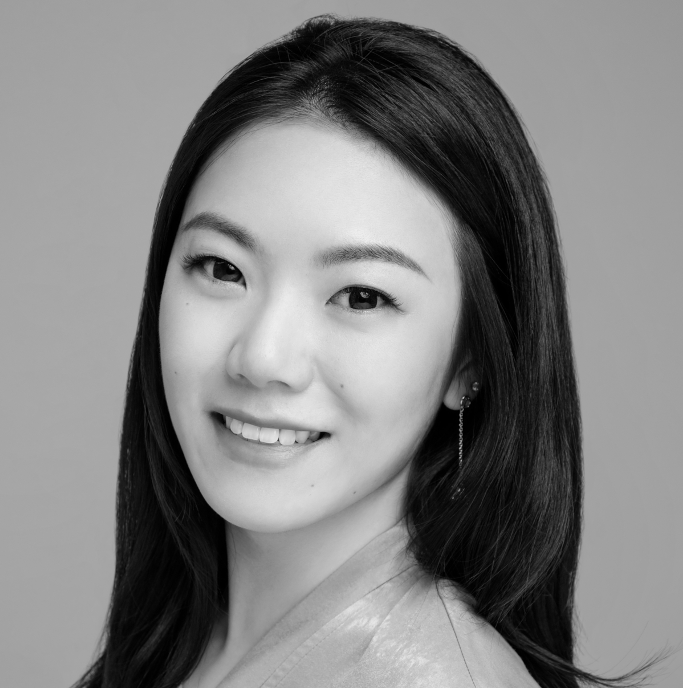

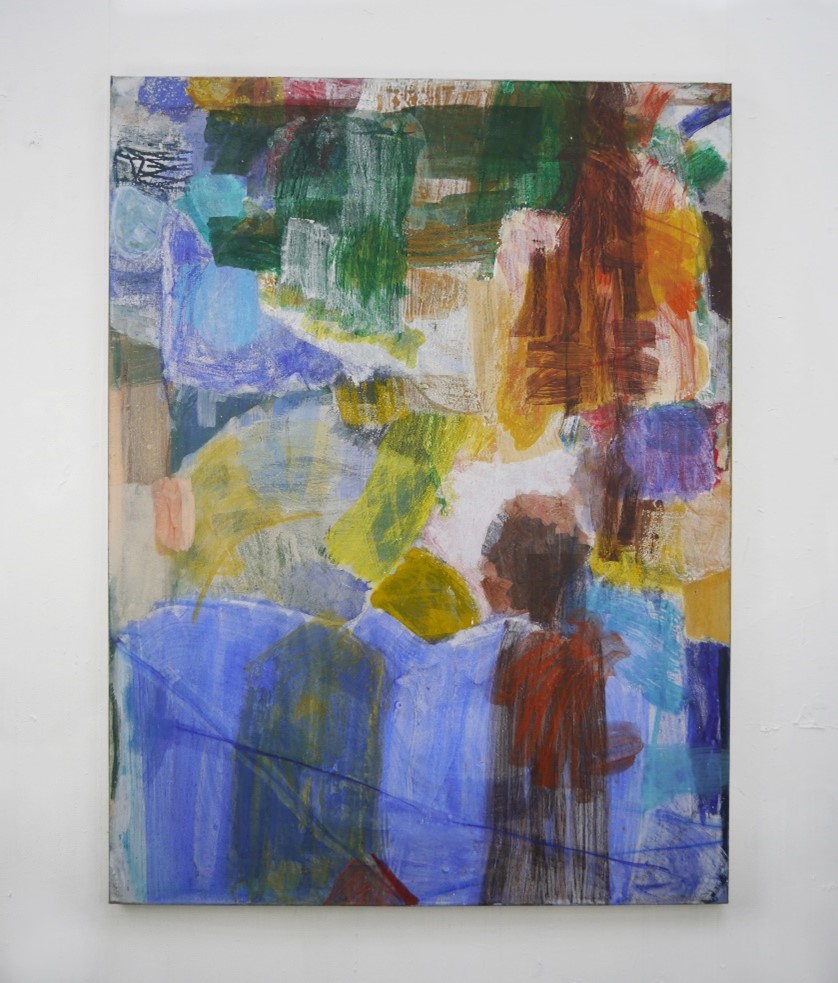

Joe Warrior – Walker, Fever Pitch, 2021, oil & pigment on canvas, 160 x 120 cm.

Emily Andrew, Gurr Johns’ Contemporary Art Advisor has partnered with Lewis Dalton Gilbert an independent curator and the creative director at A Vibe Called Tech, a Black- owned creative agency, to curate this exhibition.

For sale enquiries, please contact: Emily Andrew, eandrew@gurrjohns.com/fr