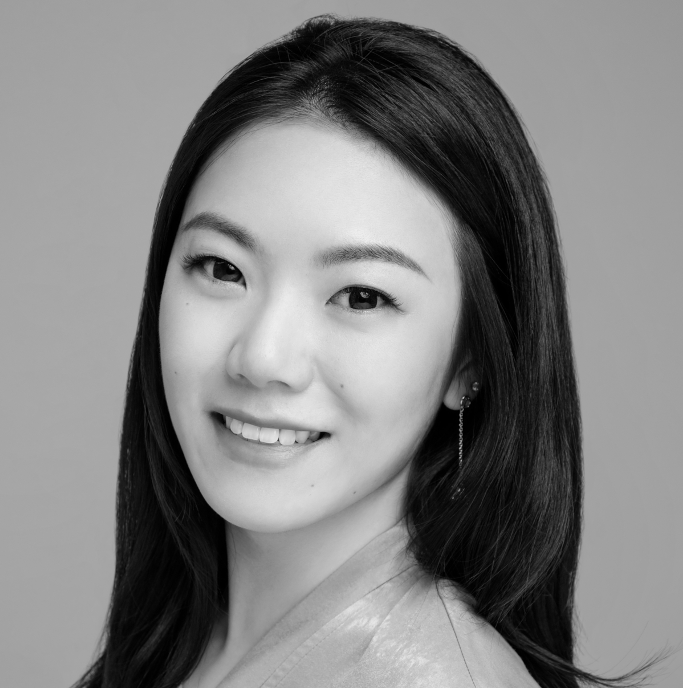

Sonia Fazlali-Zadeh, specialist for Jewels and Watches at Gurr Johns, reports on the Watch market looking at both modern and vintage models.

London’s largest public watch show will be held again the 26th and 27th March 2021 at Grosvenor House, Mayfair offering all things watch related from on-site insurance valuations, accessories and repairs to the opportunity to source and buy exquisite and rare watches. For any watch enthusiast it will also offer the chance to get more insight into shifting trends and new products as well as reflect on what has been achieved over the past year.

New watches/technologies in 2020:

This year has been unusual and difficult in every way and that extends to the watch industry with key events such as Baselworld being cancelled and the normal calendar of new releases for watches completely abandoned.

Most surprising of all was the relative silence from Rolex and Patek Philippe for the first half of the year. The wait however was worth it when news was released in June of the new Patek Philippe Ref: 6007A-001. A limited edition of 1000 pieces, the watch celebrates their new centralised manufacturing premises – a huge break from the past and Swiss watch manufacturing history of multiple specialised locations – and just as the new building represents a coupling of sacred tradition and innovation, the watch also beautifully looks both to the future in its design, especially in its stainless steel case, which apart from the Nautilus and Aquanaut models is a rarity for Patek Philippe watches, as well as the stylised carbon fibre design in the centre of the dial and the luminescence on the hands and numerals (it is the only watch in the Calatrava family to have this), and to the past – keeping all the desired and traditional elements of a Patek Philippe watch.

Audemars Piguet has also been rather silent but in a different way – instead of officially announcing all their new models they have started just posting them to their website, which means to be in the loop you need to regularly check their website – maybe they have decided to go for the personal touch and contact their client base directly but let’s see how long they abstain from official press announcements. Their new Royal Oak Jumbo Extra-Thin with Diamond Indexes released in the first half of the year was limited to only 70 pieces and was also geographically limited – specifically retailing only in Tokyo. It is the first Jumbo to be offered in a rose gold option and the use of diamonds as the indexes adds just the right level of bling to add an extra luxury element in a classy discreet way; its extra-thin design also a nod to classic vintage dress watches.

We also see a popular theme of having blue dials in the new model releases of this year – not only with the Patek mentioned above but the new IWC Portugieser IW344001, the Audermars Piguet Royal Oak Concept Frosted Gold Flying Tourbillon, arguably their most impressive recent new release, the Carl F. Bucherer Manero Flyback Chronograph Blue Horizons, a beautiful rich blue Grand Feu enamel dial for the Patek 5370 Split-Seconds Chronograph fitted to a matching blue alligator strap and the blue satiné soleil dial of the new Panerai Luminor Marina PAM01313 also on a blue alligator strap to name just a few – it seems a blue dial is a must have for your watch collection this year.

Finally, in terms of 2020 model releases, a quick word on new technologies, of which Hublot’s Big Bang is probably the most high profile big watch brand in the smartwatch game. A much smaller diameter size than the previous Hublot Big Bang Referee, it also features the one click strap attachment system, which makes customising the colour of your strap an easy tool-less task. With a Qualcomm Snapdragon Wear 3100 processor the watch is compatible with both Android or iOS phone operating systems, and features the Google Play store, Google Pay and Google Assistant within the watch itself. It is the perfect watch for art lovers – the first edition was launched with a series of eight dials created with the artist Marc Ferrero, moreover every three hours the dial changes colour, and each full hour is punctuated by an animation by the artist that lasts five seconds. This is a watch that will certainly get both your own and admirers’ attention when worn! It also reaffirms Hublot’s commitment to appealing to the younger generation and ‘edgy’ design.

Secondhand market review:

The vintage watch market remains strong this year with three new world records being set for vintage Rolex watches: a 1955 rose-gold Oyster Chronograph 6034, a 1979 COMEX Submariner 1680 and a 1969 Mark II Red Submariner 1680 with a tropical dial, all sold by Antiquorum. The 6034 is rare to find in rose gold, the most recent previous auction sale was in 2014 where it achieved $68,200; this year it made $660,400. The COMEX Submariner 1680 was also last seen at auction in 2014 making CHF$191,000, this year it made CHF$524,000. But we don’t need to look at such vintage watches to see incredible prices being achieved.

Recently we have seen the Patek Nautilus 5711 blue dial make a huge return for owners who only had to hold onto it for a couple of years, buying it new (if you were on the waiting list) for about £23,000 and selling it for a market value of about £60,000. This watch was relatively common to find in retail stores 10 years ago but quickly became one of the hardest watches to get hold of on the secondhand market and one of the most desired with huge hype around the model. It has a timeless design that has not needed to change much since it was introduced in the early 1970s and will not look out-of-date for the foreseeable future. This year we have seen a slight price adjustment, which was necessary as many owners of the model would have thought it made more sense to sell it for such a high profit than to enjoy wearing it and risk scratching the watch, as a result the market became somewhat flooded resulting in a decrease in its value but although the peak is over they continue to do very well.

Vintage watches can provide a strong investment platform but invariably one needs more information and education on what can be an investment piece, as well as the ability to spot fakes and ‘assembled’ watches (watches that are made of genuine parts but which are not genuine per se). Moreover an important factor in vintage watches is the condition of the watch. In the three record setting watches named above they were all in excellent condition and extremely rare. However excellent condition is not as straightforward as it sounds as originality is paramount – if the watch is in excellent condition because it has recently been polished or had any part of it restored that would in fact make it less valuable than the same watch with original parts in worse condition: honest patina (the natural changing colour of the dial), scratches, nicks and fading that have resulted from the age of the watch can enhance its desirability. But finding this originality is incredibly rare, as many watches have been serviced over the years. It is common, even today when sending a watch in for service, for parts to be replaced with slightly different replacements, or the lume on the dial to be repainted, or for the case to be polished – removing hallmarks and thinning the lugs.

We continue to see collectable chronographs from brands such as Rolex and Omega do well, however the astonishing high prices from a few years ago have levelled-off and we are seeing prices much more in line with the market as a whole. Where the Nautilus has dropped off slightly as mentioned above, we are seeing a growing success for its little brother the Aquanaut, with a rare blue dial version sold for $253,000 by Antiquorum in July 2019.

Military watches continue to do well often because collector’s are drawn to their unique history and provenance. We at Gurr Johns had the privilege of exhibiting such a watch for our inaugural ‘By Appointment: Art and Jewellery’ exhibition – a 1940 Longines Weems very rare Sidereal stainless steel watch, reference 4356, ordered for the US Navy with a certificate of authenticity from Longines. There are very few of these watches remaining, with many having been destroyed during the McCarthy period (Senator Joe McCarthy 1950-4) due to the red enamel stars that were on the dials being regarded as too evocative of the socialist Red Star symbol – this watch has had the stars removed and upon close inspection you can see where they would have been next to the numerals 3 and 9 – again an imperfection that makes the watch more valuable as it places it in a historical moment. These sidereal watches were used for navigation by turning the dial to fix on a reference star in order to determine one’s current position and change in angel relative to that star.

Some collectors also like military watches because their dial sizes are more of today’s standard with many non-military vintage dials having much smaller dial diameters. These oversized military dials were due to the fact that the watches were usually worn over military uniform sleeves.

Conclusion:

I’ve only touched on a few things in this article because the world of watches is immersive and hugely multifaceted. What is certain is that value in watches is not about its case material, size or diamond weight – rarity, condition, provenance and its complications are the greatest compelling factors.

To date the most expensive watch in the world was of recent manufacture and made of stainless steel not platinum and featured no diamonds. It auctioned for CHF $31,000,000 in November last year – the Patek Philippe Grandmaster Chime ref. 6300A; its creation took over 100,000 man hours and seven years, moreover, with twenty complications it is undeniably the most sophisticated and complicated wristwatch in the world. For most of us that falls slightly out of our price range but take a few zeros off and there will be plenty of watches to titillate and tempt at The London Watch Show next year!