Gurr Johns: Perspectives sees our specialists share their views, opinions and insights about the art world.

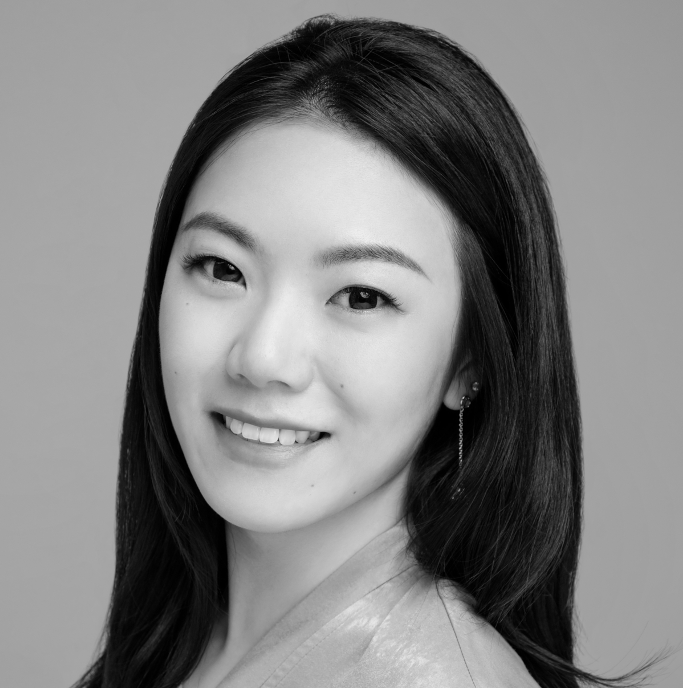

In the latest in the series, Ben Clark (CEO) and Mark Adams (Senior Art Advisor, London) discuss the shifting dynamics in the global art market, reflect on new and emerging trends, as well as one or two which aren’t quite as transparent as they might seem..

*How has a day in the life of a Gurr Johns Art Advisor changed in the past 15 months?

Ben Clark (B.C.) Being grounded in London and unable to visit clients and engage with them in real time and space has been a huge challenge for all of us. The silver lining is that as a global team, we have really pulled together. With offices in three key continents and access to an international network of over 50 specialists has meant we can genuinely be the eyes and ears on behalf of our clients and that has been a huge advantage.

As advisors, our role as ‘filter’ has become ever more critical over this period. With the benefit of objectivity, my current default position is to be highly selective and act with caution – whether at auction or private treaty sale. However, I have unearthed my passport and I can’t wait to jump on a plane.

Mark Adams (M.A.) Personal contact or the lack of it– I long to meet my clients face-to-face again and to look at art with them. However business-like we have all become, I think that the majority of players in this industry joined because they love art. I’ve really missed the experience of standing with a client in front of a great painting and watch as it does its work, enchanting them. It’s the best experience in the world.

*How would you describe the current state of the art market?

B.C. The recent evening auctions in Hong Kong and New York have shown it’s a sellers’ market with a huge imbalance between supply and demand. Certainly on the demand side, the day sales offer better insight into the broader market. Reassuringly their results suggest that any contraction in the global market over the last period has been short and very sharp, rebounding far quicker than many feared last Spring. Ultimately I’m not surprised, as it is the essence of human beings to be interested in art and creativity.

M.A. Goodness – big question. I worry that we’re in such a time of unknowable change at the moment, as we prepare to re-engage with the real world, that anything I say will sound ridiculous in six months. This year has seemed a little like a dream.

Money has been plentiful, good work has been scarce, and everyone’s been bored, and that’s a decent enough recipe for a healthy market. What I have noticed though is a growing commodification of art at sale which has been exacerbated by the detachment of having to buy without seeing. I’ve seen pictures bought as a result of an algorhythmic evaluation which should not have sold, and vice versa. It’s not clever and I’ve always seen it as a bad portent. It’s certainly something that we at Gurr Johns hope to render unnecessary for our clients by not stinting on our homework.

*Is technology driving the art market?

B.C. There’s no doubt that online sales, innovative private sales apps and viewing rooms have saved the global art market from what could have been a massive downturn. That being said, whilst I don’t believe that technology is driving the market, it is certainly a facilitator and can offer a necessary simplification of out of date processes.

The pandemic has created an environment in which existing technology can flourish and has forced behaviour

al change within companies and teams that were otherwise resistant and egos have had to be set aside. For instance, the conversation about moving auction catalogues online has been raging for over a decade!

M.A. Covid seems to have achieved in a year what the auction houses have been trying to bring about for a decade –we’re all mouse-clickers. I think though that we have yet to fully understand what this means for the psychology of auction. We’ve seen extraordinary and anomalous prices become a regular feature of marquee sales – consider the $100m Picasso portrait of Marie-Thérèse sold at Christie’s this month. I think that this may have a lot to do with the comfortable isolation from reality that can result from interacting through a screen and bidding on something in another time zone. I’m sure there may be buyers who are already regretting a buying bid which they would never have made in the cold light of day.

I wonder too what technology will mean for the role of the real-life art fair. I’m probably going to annoy people by suggesting that the art fair industry had got out of hand by the time Covid hit. There were too many and many had grown too big: going to them all risked becoming a chore. Many galleries were being forced to maintain two complete staffs: one for the bricks and mortar gallery, and one for the art fairs which FOMO obliged them to attend. While this may not be a problem for mega galleries, it was a huge strain for many middle-ranking gallerists.

*Poachers, gamekeepers or chameleons? Have the international auction houses become unrecognisable?

B.C. The global auction houses have been remarkably agile in pivoting to the new sales formats. Adapting to a brave new art world in the wake of Covid is something we have all had to do. For me, to label auction houses as any of the above, is to misunderstand the inevitable development of historic brands that are morphing, or more accurately evolving into the ultimate marketing platforms.

For today’s art collector, Gurr Johns’ role as an independent art advisory business, acting as a ‘filter’ offering impartial advice and objective appraisals is more important than ever. Our reputation is built on transparency. As advisors – rather than

salespeople – we always act in the best interest of our clients and measure our success on the strength of our long-term relationships.

M.A. I’m going to show my age: I joined Sotheby’s in 1989 and learned my trade there in very different times. I think it’s a shame to see the connoisseurial aspect of the London auctioneers’ business being diminished in their desire to become luxury retailers.

Sticking to the question, though, auction houses have certainly never been gamekeepers – I joined Sotheby’s at the height of one scandal and left as another broke, with several in between. So I’m going to plump for poacher, with a deft touch of the chameleon.

The main change has been the growth in importance of the financial sideshow that increasingly underlies the auction process. Guarantees, and more particularly, Third Party Guarantees, create multiple conflicts of interest between the auctioneers and the vendors whom they are contracted to represent, and makes a nonsense of the assumption in British law that the auction process is a level playing field. It feels as if we’re overdue for another scandal and I think that this may well be it.

To find out more about Art Advisory Services at Gurr Johns, visit: https://gurrjohns.com/fr/art-advisory/

Contact: ukadvisory@gurrjohns.com/fr (UK)/ usadvisory@gurrjohns.com/fr (US) asiaadvisory@gurrjohns.com/fr (Asia)